Has anyone ever asked you about this question? If yes, I’m sure you might have got confused between UTR and UPI numbers. I will help you identify what is UTR number in PhonePe.

PhonePe is your “one app for all things money.” You can easily pay bills, recharge your phone number, send money and much more. It is a mobile payment app that gives you all these benefits mentioned above.

It is like your digital wallet where you can safely keep your money and pay for urgent needs when you don’t have cash on you. You just need an internet connection and you are good to go!

The UTR Number on PhonePe

Now the main question is what is UTR number in PhonePe? It really sounds like UPI when you hear it for the first time right? I’m sure you will ask once again for the person to repeat what he just said.

UTR number, as the name suggests, is a 12-digit number on your PhonePe app, which helps to find the transactions and their status. In short, it helps in monitoring your financial transactions.

You don’t have to worry much now. I will tell you about the UTR number if you use PhonePe. UTR number is called the Unique Transaction Reference, which is a code for reference in every transaction you make.

Sometimes the other person is a Google Pay user and you use PhonePe. Both apps work for the same cause but are still different. This is the main reason to get confused between the two.

Before talking about these two, it is important to learn where you can find your UTR number if you are a PhonePe user.

Where to Find the UTR Number?

I will guide you through the steps of locating your UTR number in the easiest way possible.

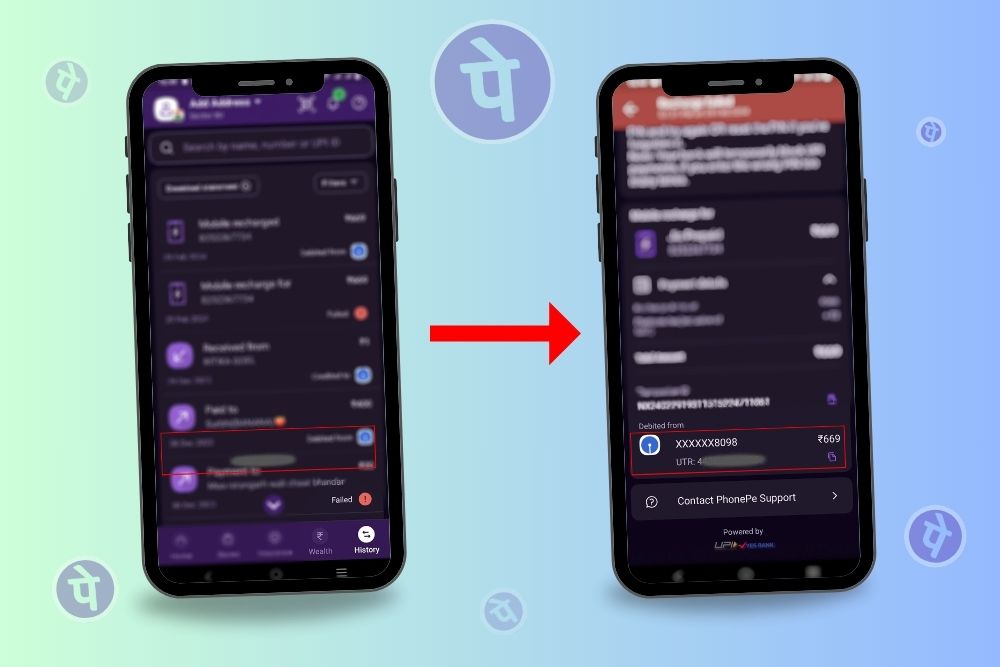

Step 1: Open your PhonePe app. You will see a series of options on your screen. At the bottom, there will be 4 to 5 options in a rectangular box.

Step 2: At the bottom right corner will be the option of “History” you have to click on it.

Step 3: Open any failed transaction and scroll down a bit.

Step 4: Under the transaction ID, your UTR number will appear in a 12-digit number. Congratulations! You just got the location for your transaction.

Other Ways to Obtain Your UTR Number

1. You also have the privilege to call the customer care helpline of your bank and ask them for the UTR number of the particular transaction.

2. Some banks also send an email or SMS for the transactions you make, which may include the UTR number.

3. If you have received a receipt for the transaction, you can see the number of transactions.

4. Not all prefer online payments, some still prefer going to the bank to check their payment status. For them, their UTR number is available on their passbooks, in front of the transaction they have made.

Note: The UTR number also appears for successful transactions.

Importance of the Number

You have successfully located your UTR number, now you might ask yourself, “ Why do I need this number?” Your answer is very simple but very important at the same time.

UTR number is like Google Maps for your online transactions. It monitors your payment processes and guides you on any wrong turn you make. If you ever get a failed transaction, your UTR number is used to track down your payment.

The number is the backbone of the digital payment system, without which handling bank operations might be difficult in today’s world.

It not only tracks the failed transactions but all transactions to find their status. You always get a unique UTR number whenever you make a transaction. So, you don’t need to remember it, just follow the steps mentioned above and you will find your UTR number.

The unique number keeps your transactions organized and less confusing, making it easy to identify the particular transaction.

Whenever the term “online” pops up, we are always sceptical about it. It is absolutely fine if you ever wonder about whether it is safe to share your UTR number or not.

Is Sharing it Safe?

Let me break the suspense for you! It is absolutely safe to share your UTR number if the receiver does not seem fishy. For example, you can share it with the bank without any second thought. In short, you can share it with anyone who officially deals with finances like accountants and financial advisors.

Since it refers to the identification of your transaction and tracking it down, you can share it with others without any concern. It does not contain any personal information or financial status. Just a reminder, don’t ever share your pin with anyone, no matter what. Never disclose your PIN even to the bank.

UTR Number and UPI ID: The Difference

Now it’s time to disclose the difference between the seemingly same functionality but different setups.

UTR stands for Unique Transaction Reference whereas UPI stands for Unified Payments Interface. UTR just keeps the track of your particular transaction and changes with every payment you make. UPI on the other hand is your unique identity under the mobile payment system initiated by the government of India.

UPI ID, helps you to receive and send money for any online transaction whereas UTR is just the identification of the transaction you make.

Therefore, the two are not the same even though they both are a 12 digit unique number. UTR identifies the transactions and the UPI ID identifies the user.

This might help you to clear the doubt in your head about the two. I hope the next time someone asks you about either, you identify them in the first go.

UTR Number on Google Pay

If the two are different then how does Google Pay keep a track on the transactions? I know you might be wondering this too. The terminology is not the same in the apps but UTR number is available in Google Pay too.

Here are a few easy steps to find your UTR number in your Google Pay.

Step 1: Open your Google Pay app. Scroll to the bottom and tap on “See transaction history.”

Step 2: Click on any transaction, you will see “UPI transaction ID” with a 12 digit number. Bingo! That is your UTR number for Google Pay.

How to Track the Transaction with UTR Number?

Now, you know the need of a UTR number, but really don’t know how to use it? Let me help you! There are two ways through which you can track down the transactional status.

- Internet Banking

These days every bank has an online domain which is known as internet banking accounts. In short, these are the mobile apps for your bank. If you haven’t installed it yet, you should.

All you have to do is open the transactional history (or any terminology for it). Click on its UTR number and track your payment.

- Customer Care Help

If you haven’t installed the app, then simply give a call on the customer care number. Ask the person for the status of your payment by providing them the UTR number.

Final Note

You have successfully figured out what is UTR number on PhonePe and every other important aspect of it. Now you can easily locate your UTR number, both in PhonePe and Google Pay and track your payment status anywhere.