Goods and Service Tax is the first thing to keep in mind while getting a GST Identification Number (GSTIN). It is a 15-digit alphanumeric identification number which is important in the GST landscape.

How to Check the GST number?

- Go to the www.gst.gov.in

- Then, click on the ‘Search Taxpayers option’ tab.

- Choose the GST option ‘ https://services.gst.gov.in/services/searchtp’

- Enter the GST number and click on the search button.

- If the number is correct it will give all the information about the company.

Benefits of GST Verification

There are many benefits of GST verification. Below are some of the reasons:

- It helps you verify the authenticity of any company or taxpayer.

- This helps you check the validity of the GST and gives you information about the business.

- This helps you avoid generating incorrect invoices.

- It allows the taxpayers to make sure that the business information is transparent and makes it easy to file GST returns.

- With this taxpayers can claim tax credits and pass them to their buyers.

- It also helps you with checking and rectifying the errors in GSTIN.

- When you verify the GST it helps you in detecting fraud.

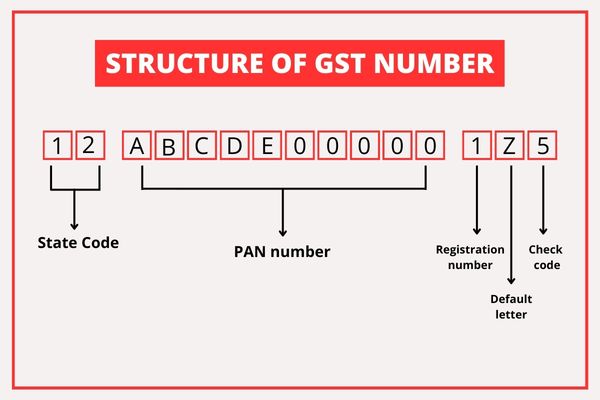

Format of GST Number

The GST number follows a specific format:

State Code

The first two digits are based on the state code of the company. The state codes range between 01-35 as per the Indian consensus of 2011. For instance, 08 is for Rajasthan, 06 for Haryana and so on.

PAN Number

3 to 12 digits in the GST number are the PAN Number of the one associated with the company registered under the GST.

Registration Number

This number tells the total number of companies or businesses registered with the same PAN. It is limited to 35. This is alphabetical code, for the first 9 digits 1-9 numbers can be used, and for the rest alphabets can be used. For instance, 1 is used for the first registration for the 10th registration alphabet A can be used.

Z

The 14th digit is the default Z common for all GST numbers.

Check Code

The 15th digit is the check code for detecting errors.

Importance of GST

The GST number has replaced the old taxation systems. Let us know about the importance of it as per the requirement mentioned in the Goods and Service Act.

Avail ITC

ITC or Input Tax Credit is the tax paid while purchasing goods or any input service in the course of business. So for using the input GST from GST payable on sales, it is important to have GSTIN for ITC.

Filing Returns

GST returns are filed under the GST Act like GSTR-1, GSTR-3, GSTR-9, and others. For filing the returns, it is important to give the proper record of the goods and services supplied and received by the government. It helps in availing the ITC. Keep in mind that you should verify the GST number.

Refunds Claim

A refund can be claimed under provisions like export of services, supply to SEZ unit, etc. To claim the refund, it is important to GSTIN with properly verified GST.

General Requirement

GSTIN is mandatory under the GST Act. It is important to get GSTIN after getting registered under the GST Act.

Complain About Fake GST

If you come across any fake GSTIN then you can inform GST authorities about it by calling +91 124 4688999 /+91 120 4888999 or by email at helpdesk@gst.gov.in.

Another way of reporting a fake GSTIN is through the GST portal. Below are the steps you can follow to raise a complaint:

- Go to the GST portal, then search the Taxpayer section and click on search by PAN.

- Enter the PAN number and captcha, and click on search.

- You will get the list of GSTs associated with the PAN number and status. Now, click on the checkbox against GSTIN and click on the report button.

- After reporting, a pop-up box will appear which will contain the legal name and other details of the business. It will have all the details like date of birth, address, mobile number, and email ID, then click on the proceed button.

- You will be asked to enter OTP in the next pop-up. You will have to enter the OTP which you will receive on mobile number or E-mail ID.

- Once you have entered the OTP, you will be redirected to delf-e-KYC and consent. It will show your name, PAN number, and legal name as per the PAN. After the consent, you can opt for either VID or Aadhar number option for e-KYC. If you choose the Aadhar number then you will have to enter the Aadhar number and proceed to validate.

- You will again receive the OTP, enter the OTP, and complete the second step of authentication. These details will be used for filing a report against the fake GST number. These will be transferred to the Central Identities Data Repository.

- After the validation, a pop-up will show with the successful msg and an ARN number. The application can be traced through this number.

Also read: How to Delete Transaction History in Phonepe

Final Note

This was all about the GST number check and its details. We hope that this article might have helped you with the GST details.